IECU Blog

How to Bounce Back After Holiday Spending

The holidays are over, and if you’ve gone over budget with your spending, it’s time to deal with the aftermath. Instead of living in a financial deficit, take steps to repair your budget as soon as the last guest leaves.

Here’s how you can get your budget back on track for the new year.

Review your holiday spending

Before you take steps toward financial post-holiday recovery, take stock of your finances. How much credit card debt did you rack up this season? Did you dip into a savings account that now needs to be replenished? Spend some time crunching the numbers so you have a better idea of what kind of recovery steps you need to take now.

Choose your recovery process

Once you’ve got your numbers clear, you’ll need to decide on a path toward recovery.

If you’ve really blown it this season, and you’ve got multiple credit card balances to pay off, you may want to consolidate your debt. You can accomplish this by taking out a personal/unsecured loan and then using the funds to pay off your credit card debt. You’ll be left with a single, low interest payment to make each month.

Alternatively, you can pay off one credit card bill at a time, maximizing payments on the bill with the highest balance, or the one with the highest interest rate, until it’s completely paid off. Once you’ve crossed one balance off your list, move on to the next until you’re debt-free. Don’t get stuck paying just the minimum balance on each card each month, or you may be paying those credit card bills for years to come.

Trim your budget

Take a close look at your monthly spending to find places to cut back. Are you paying multiple subscriptions each month for apps you never, or rarely, use? Those small fees can add up quickly. Can you cut back on your grocery bill? Perhaps you’re overdoing it on takeout or dining out. Is there any way you can negotiate with a service provider, such as cable or internet, for a better monthly rate? Maybe it’s time to shop around for a less expensive auto insurance policy. Trim the extra wherever you can to free up more money for paying down debt.

Put your holiday resources to work

Along with a pile of debt, the holiday season may have left you with some extra cash through work bonuses, tax returns and gift money. Put these resources to work by using a portion of this money, or even all of it, toward paying down your holiday debt. It may sting to use “extra” money for something as utilitarian as a credit card bill, but getting rid of the debt faster so you can return to your normal spending patterns can motivate you to make this choice.

Go on a shopping detox

Before the holidays, you shopped until you dropped and then you may have shopped some more. Now, it’s time for a shopping detox. Take a break from the mall this month and close all those open tabs presenting your favorite clothing brands. Resolve to swipe the plastic only for essentials this month, or at least to keep discretionary purchases to a minimum until your budget recovers. Trimming expenses is never fun, but remind yourself that it’s only temporary until you’re financially fit again.

Make a plan for next year’s holiday season

It’s never too early to start thinking about next year’s winter holidays. Instead of using the months before Christmas stressing out over how much you’re spending, and the months after the holidays stressing about paying your bills, pay a little bit toward your holiday expenses each month of the year for a much less stressful holiday season. When you open a holiday club account at , you can set up an automatic monthly transfer from your checking account to feed your holiday savings.

If you blew your budget this holiday season, you’ll need to take steps to help your finances recover. Use the tips outlined here to get started.

Check Washing - What Is It and How to Protect Yourself

Despite the increasing digitization of money management, there is still a place in the economy for paper checks – and along with them, check-washing scams. According to the National Check Fraud Center, check washing has an $815 million annual price tag to U.S. consumers. Unfortunately, instances of check washing often go unnoticed until it’s too late to undo the damage. Here’s what you need to know about these scams and how to protect yourself.

How the scams play out

In a check-washing scam, a scammer steals checks from the mail, changes the payee name and/or the dollar amount, then deposits them into their own accounts.

The scammer pulls off this ruse by stealing outgoing mail from private mailboxes or lifting envelopes out of public mailboxes using “fishing rods” made of strings attached to a sticky substance. After lifting a pile of envelopes, the scammers keep those appearing to contain checks, and then discard or return the rest. With checks in hand, they’ll use household chemicals, like acetone or bleach, to erase the ink on the stolen checks, and then rewrite the numbers and/or the payee. Finally, they’ll deposit the checks into their own accounts.

Scammers sometimes take the scheme one step further by using the checking account details found on the check to commit further crimes against the check-writer. This can include producing counterfeit checks in the victim’s name, as well as fake IDs, driver’s licenses and passports. The victim may only learn about these crimes when they begin receiving overdraft notices or are informed that their ID is no longer valid.

Check washing is a particularly dangerous scam since victims may not learn of its occurrence for weeks, or even months. They may only discover the ruse when they review their monthly checking account statement and discover that the check amount and/or payee has been altered. Or, it may only happen when the intended recipient reaches out to let the check-writer know they still have not received the check. The scam’s discovery is more likely to be delayed when the scammers have not modified any information on the check and have simply stolen and deposited a check made out to “cash”. Unfortunately, many financial institutions do not offer complete protection on fraud that is not reported within a few days of its occurrence. Some offer partial protection for up to 60 days.

Protect yourself

Law enforcement agencies on a local and federal level, including the U.S. Postal Inspection Service and the FBI, have task forces to help stop check washing. They offer the following tips for keeping your checks and your information safe:

- Whenever possible, use mobile and online banking services and P2P systems as a replacement for checks.

- When writing checks, use black ink, preferably gel. The ink found in blue ballpoint pens can be easily removed with acetone.

- Don’t raise your mailbox flag when there are bill payments inside. Hand this mail directly to your carrier or mail it from the post office.

- Retrieve your mail daily and never leave the mailbox full overnight. If you’ll be traveling, you can arrange for the post office to hold your mail for up to 30 days. Alternatively, have a friend retrieve your mail so it doesn’t pile up.

- When mailing checks, use envelopes that have security tinting.

- Shred or burn all canceled checks, checks deposited through your mobile app, credit card statements and bills.

- Review your checking account activity frequently. Ensure all checks have cleared for the correct amount and to the correct payee. You can generally access this information through your financial institution’s mobile banking app or website.

- Store your checks in a secure place within your home.

- Write out your checks to a specific person or business. Avoid making checks out to “cash”.

How Can I Save on Holiday Shopping?

Q: The holidays always have me worried about money. With inflation soaring, I’m more stressed than ever. How can I save on my holiday shopping this year?

A: If you’re worried about making it through the holiday shopping season in the midst of record inflation, you’re not alone. A recent survey shows that 59% of American shoppers are stressed about buying holiday gifts due to higher prices this year. With some careful planning, though, you can enjoy stress-free holiday shopping. Here are seven easy ways you can save.

- Shop early

Experts are urging shoppers to hit the stores earlier than normal this year to take advantage of early-season sales. Lots of big-box stores are struggling with a supply surplus thanks to an inflation-triggered decline in demand. This will likely lead to sales events to make room for more current inventory. Shop these sales for big savings.

- Set a budget

Before you start shopping, build a reasonable budget for your holiday shopping. Make your budget easier to keep by allocating a specific amount for every gift, shopping with cash and/or reviewing your budget often.

- Shop with a list

Instead of blindly hitting the stores, make a list of every gift to buy for friends and family. You’ll be far more likely to stay within budget when your purchases are pre-planned.

- Leave some last-minute shopping for Green Monday

While it’s best to do the bulk of your shopping early in the season, you can leave some last-minute gift-shopping for Green Monday on Dec. 14. This is when retailers make their final pre-holiday markdowns.

- Think outside the box

If ever there was a holiday season to get creative with gifting, this is it. Retail inventories are full of products that were backed up during the post-pandemic supply-chain disaster. Think furniture, home decor and more. While these items may not be typical holiday gifts, there’s no real reason you can’t delight a loved one with a new office chair, exercise bike or coffee organizing station.

- Give gift cards

Protect your gift list against inflation by giving some gift cards. You can find discounted cards on sites like GiftCardGranny and CardCash, or use cash-back apps to earn them at no cost. Gift cards are easy to shop for, easy to budget for and appreciated by the receiver.

- Use apps to save

In 2022, there are so many apps that can help you spend less on your shopping, and even put money back into your pocket. Try coupon-scanning apps like Honey, cash-back apps like Ibotta and points apps like Drop to save this season.

- Drop. This free app allows you to link your credit and/or debit card, and shop directly from the app at 300+ retailers. Earn points back on every purchase. Use your points to purchase gift cards.

- Honey. Why pay full price when you can get the same item for less? This coupon-scanning app will automatically find promo codes and coupons for items you’re searching for so you can save on your shopping. You can earn points on purchases made through the app, too.

- Fetch. Earn points on grocery purchases by scanning your receipts after you shop. Redeem points for gift cards.

- Ibotta. Get cash back for your purchases by scanning your receipts with this app. Use for online purchases, and by linking store loyalty cards for in-store purchases, too. Redeem points for cash or gift cards.

Holiday shopping may be a race against inflation this year, but with a little pre-planning, you can complete your shopping with your budget intact. Use the money-saving tips outlined here to get started!

Don't Get Caught in an Election Scam

- Eleventh-hour campaign contributions

This scheme targets voters right before elections, asking them to make a donation toward their preferred candidate’s campaign. They’ll claim to represent the candidate, and inform the target that the candidate just needs one big push to move to the front of the line. The target is led to believe their small donation will make their candidate emerge as victor on election night.

Unfortunately, if the target believes the caller and makes a donation, they’ll only help line a scammer’s pockets. Sometimes, the scammer will take it one step further and use the credit card information shared to rack up a huge bill on the victim’s tab.

Stay safe: If you’d like to contribute to a candidate’s campaign, reach out to campaign headquarters on your own through their website.

- Polling for information

During election season, informal poll-takers and petitioners are everywhere. They may approach you in the parking lot of a supermarket, at a ballgame or even at a music festival. Once they have your attention, they’ll ask who you’re voting for, request that you fill out a survey or have you sign an election petition on a particular issue. But first, they’ll need your personally identifiable information (PII), such as your name, date of birth, home address and even your Social Security number. You may be compelled to participate because you’re happy to help your chosen candidate in any way possible. If you do, though, you’ll be sharing your information with a scammer.

Stay safe: Guard your PII like the treasure it is and never share any of it with an unverified contact. This includes impromptu surveyors, pollsters and the like. If you do decide to fill out a voter survey, be super-selective about the information you choose to share. Don’t share your Social Security number, driver’s license number or any other information that can be hijacked for crime.

- Voter re-registration

Voting has changed a lot since COVID-19 entered our world. Absentee voting is far more popular than it used to be, and many voters may find the rules and regulations confusing. Scammers, of course, will take advantage of this to get at your information and your money.

Here’s how: In the weeks leading up to Election Day, scammers send out bogus voter registration forms for voters. They may include a claim that your name has been mistakenly removed from the voter rolls, but you can easily get right back on by filling out this form and mailing it out to them. Alternatively, they’ll reach out by phone, text or email, telling you to register by responding. Naturally, these messages are the work of scammers, and if you share your info, you’ll be sharing your sensitive information with crooks.

Stay safe: Remember that you can only register to vote by mail. In addition, there’s no reason to believe your registration is no longer valid just weeks before Election Day. If in doubt, you can always search your state’s Secretary of State website. Also, if you choose to register to vote while in a public area, take the form home with you to mail in later instead of leaving it behind with a group of volunteers.

Election season means election scams are rampant. Do your due diligence before contributing to a campaign, taking a survey or registering to vote. Stay safe, and may the best candidates win!

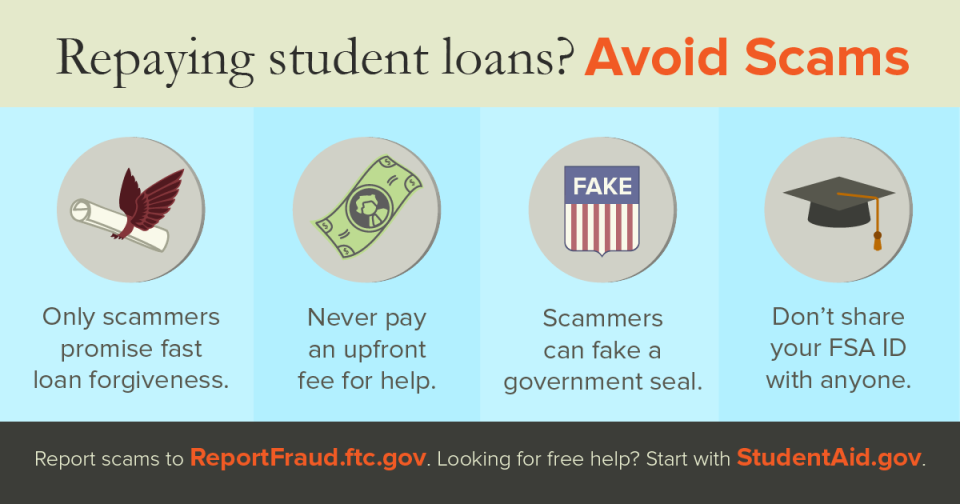

Student Loan (UN)forgiveness

The U.S. Department of Education recently announced another extension of the student loan payment pause. This time the pause runs through August 31, 2022. That news puts student loans back in the headlines, along with discussion of some possible, eventual loan forgiveness for all. So, can scammers be far behind? No. No, they can’t.

In fact, student loan debt relief scammers are already here. But a federal student loan forgiveness program for all borrowers is NOT. Scammers might promise a loan forgiveness program — that most people won’t qualify for. Or they might say they’ll wipe out your loans by disputing them. But they can’t get you into a forgiveness program you don’t qualify for or wipe out your loans.

To steer clear of a student loan forgiveness scam, know this:

- There are specific federal loan forgiveness programs. There are the Public Service Loan Forgiveness (PSLF) and the Teacher Loan Forgiveness programs, to name a few. There’s even a Public Service Loan Forgiveness limited waiver program going on right now with a deadline of October 31, 2022. If you have questions about qualifying for federal loan forgiveness, contact your loan servicer or the Department of Education directly.

- Don’t share your FSA ID. Some scammers claim they need your FSA ID to help you, but don’t share your FSA ID with anyone. Dishonest people could use that information to get into your account and steal your identity.

- You don’t need to pay for help. There’s nothing a company can do that you can’t do for yourself — for free. If you have questions about your loans, or how you’ll repay them after the pause ends in August, contact your loan servicer.

If there is eventually a broader federal student loan debt forgiveness plan, the official word will come from the Department of Education, not random calls, texts, emails, or social media messages. Spot one of these scams? Tell your friends, and then tell the FTC at ReportFraud.ftc.gov.

*** Reference: https://consumer.ftc.gov/consumer-alerts/2022/05/scammers-are-offering-student-loan-unforgiveness

Job Scams

It’s an amazing employment opportunity – or is it? Scammers often hijack the job market and ensnare hopeful job seekers into their schemes. If you’re job-hunting, it’s a good idea to review the way these scams play out and how you can avoid them. To help you out, we’ve put together a short primer on what you need to know to stay safe from job scams.

How the scams play out

There are several variations of job scams. Here are the most common ones:

- Bogus job listing. There’s a Help Wanted ad for a dream job, and the job-seeker applies with great optimism. They’ll share their information and even pay a small fee to submit their resume, or to cover alleged job supplies. Sadly for them, the job doesn’t actually exist and they’ll never hear from the “employer” again.

- Imposter hiring. An alleged rep from a well-known agency, government institution or hiring firm reaches out to a target asking them to send the funds to cover a screening fee to be considered for a job. While the job does exist, the representative is a scammer, and the money the victim has shared will go directly into the scammer’s pocket.

- Phishing emails. Like any phishing scam, a victim is targeted directly via email. The email will offer the victim a fantastic job, but first ask that they share confidential information. If the victim complies, they’ll be giving their personal information to a scammer.

- Inflated payment scam. In this ruse, a target will be hired for a remote position. When payday arrives, the victim will receive a check written for an amount that is for more than the “new employee” should have received. The employer will ask them to cash the check and mail back the extra funds. Unfortunately, a few days later, when the check doesn’t clear, the victim realizes they’ve been scammed.

How to spot a job scam

Learning to identify the signs of a job scam can help you avoid them and find gainful employment. Here are some red flags to watch out for while job-hunting:

- Unprofessional emails. If the emails you receive from a would-be employer or HR rep are riddled with spelling mistakes and typos, or are formatted in an unprofessional manner, you may be dealing with a scammer.

- No physical company mailing address. Even a business that mostly hires remote employees needs a street address. If you can’t seem to find one on the company’s site, and your “employer” refuses to share this information with you, the company may be a cover for a scam ring.

- Upfront fee. Most legitimate employers will not ask a new hire or hopeful employee to pay a fee for supplies or to submit a resume. If you’re asked to do so, you may be looking at a scam.

- Inflated checks. If you receive a check from a new employer that is made out for more than your wages or salary, and you are asked to send back the surplus, you’re being scammed. Don’t cash the check and terminate all contact with the “employer”.

- Premature request for information. While it’s perfectly okay for an employer to ask a new employee to share their Social Security number, date of birth and even their checking account information, these details should not be shared until an official contract is signed and the employee is sure the job and the employer are legit. In fact, it may be a good idea to hold off on signing up for direct deposit of your paycheck until you’ve been employed for a while and you know the job is a keeper.

- You’ll be underworked and overpaid. If a job is promising a high salary for very little and/or very easy and unskilled work, it’s likely a scam.

Before applying to or accepting a job offer, do thorough research. Ask for references of past or current employees and check out the company website to see if it’s secure and has real information about the firm, including a street address. Check out the company’s social media pages, like LinkedIn, as well. Finally, don’t be afraid to ask the employer, or the person doing the hiring, any questions you may have about the company or the job.

Job-hunting can be stressful, but getting caught in a job scam can bring that stress to a whole new level. Stay alert and stay safe by following the tips outlined here.

Financial Literacy Month

“April showers bring May flowers,” goes the old saying. It’s also a great lesson about the importance of saving – where weathering some light showers can pay dividends during the nicer days that are to come. Here are some fun activities you can do to expand your financial knowledge.

Make a financial date night

Most people dread doing anything with their money. Unless there’s a serious issue, they don’t think about their bills or their paychecks. When something serious comes up, they do little more than panic and figure out how much money to throw at it so it’ll go away. Money is scary, and not dealing with it is the easiest thing to do.

If you want to improve your knowledge of finances this month, schedule a financial date night. It doesn’t matter if you’re partnered or on your own, it works the same way. Pick a day when there’s nothing good on TV, no major social events and no serious distractions. Put some light music on. Pour yourself a glass of wine. Sit down with your bills, your paycheck and anyone else who matters to your finances, and figure out where you stand.

This can be a time to make dealing with your finances fun. You can do a little daydreaming and figure out what your future looks like. Jot down some goals and think about how you can achieve them through your monthly budget. Make a financial date night part of your monthly routine!

Build a list of needs and wants

One of the best ways to build an efficient budget is to start from a list of priorities. What do you spend your money on each month? Make a list of all your expenses. Then, break them into one of three categories.

The first category is the essential, non-negotiable bills. These are your big-ticket essentials that have serious consequences for missed payments. Your auto loan, your rent or mortgage, your utilities, and your taxes go here. This is the bare minimum you need to bring in each month.

The second category is the essential, negotiable obligations. These are unsecured loans such as credit cards and student debt. You need to pay them, but if you have to miss a payment, these are the ones to miss. Paying these off is a priority after you make your essential payments, and you may have some room to negotiate and reduce these payments if things get dicey.

The third category is the nonessential spending. This is everything else you spend money on each month. This is the best place to make cuts when you want to shift your priorities.

Making a list of priorities is the first step to making solid plans and reshaping your own financial destiny. When you know where your money is going, you can start to move from financially existing to intentionally spending. That’s the beginning of improved financial literacy.

Take charge of your retirement planning

Financial security means planning for the day when you can’t work anymore. Financial literacy is all about taking an active role in thinking about that future. There are a few concrete steps you can take in April to put yourself ahead of the game.

If you’re not already doing so, contribute to your employer’s 401(k) program. Most employers will match contributions up to a certain level. If you’re not contributing enough to get the full amount of that match, you’re leaving money on the table. Set up automatic contributions out of every paycheck to automate that savings.

April 15 is the last day to contribute to an IRA. Even if you’ve already filed your taxes, you can file an amended return to get credit for your contribution. More importantly, you can add to your retirement nest-egg and take advantage of the tax benefits of those accounts.

There’s also no shame in asking for help. Retirement laws are complicated, and it takes an expert to really understand their intricacies. Speaking with a qualified financial planner can take some of the guesswork out of it. This conversation can also help you clarify what retirement looks like: what your goals are, how much you need to save to achieve them and what programs are available to help you get there.

If you’re counting on Social Security to provide for your entire retirement, you’re in for a rude awakening. Benefits are shrinking and the fiscal solvency of the program is always in danger. Taking an active role in your retirement planning is the best way to get some peace of mind about your future. It’s never too late. Retirement planning you do at 50 is better than retirement planning that never gets done!

The Beginner's Guide to Credit Cards

How credit cards work

When you use a credit card for a purchase, you’re borrowing money from the card issuer. You’ll repay some or all of it by the bill’s due date. At that time, the credit card company charges interest on your remaining balance. This amount of interest charged is determined by your card’s annual percentage rate, which refers to the annual cost of borrowing money with your credit card.

Applying for a credit card

First card? You might be best off starting with a secured credit card, which offers a modest line of credit. For this product, you’ll deposit funds to act as collateral in case of missed payments. However, if your payments are timely, you’ll get the deposit back after a predetermined amount of time. Then, you can close the account and open an unsecured credit card that doesn’t request a deposit for collateral.

As you consider your credit card options, look no further than your credit union. As member-owned cooperatives, credit unions consistently offer credit cards at lower interest rates than those issued by big banks.

Using your card

You can use your card to make purchases at any retailer that accepts your card, and charge up to the available credit limit on your card. However, to help keep your credit score high, it’s best to keep your credit utilization below 30% of the available credit.

Statements

You’ll get a credit card statement each month. It will include the following:

- Summary of transactions since the last billing cycle. This includes purchases, payments, balance transfers, cash advances, fees, interest payments and more.

- The balance from the previous billing cycle.

- The minimum payment due.

- The payment due date.

- The number of days in your billing period.

- Your credit limit and available credit.

- Available or redeemed rewards.

It’s important to review your statement for accuracy and note the bill’s due date so you don’t miss a payment.

Payments

If you pay your entire bill by its due date, you’ll avoid paying interest on the month’s charges and only pay the cost of the actual purchases. However, if you only make the minimum payment, interest will continue to accrue on the leftover balance.

Maintaining a high credit score

Here’s how to build your credit score and keep it high:

- Pay your bills on time.

- Pay more than just the minimum due.

- Keep your credit use low.

- Ask for a credit limit increase after nine months of responsible use.

- Keep your cards active.

The Credit Union Difference

With February being our birthday month, we felt it fitting to give our members a little history on how credit unions came to be!

As a member of IECU, you know credit unions are always striving to serve their members and community. We value each member’s input as an equal owner in the credit union, and we offer flexible loan terms, low-cost accounts and higher dividends to help members achieve and maintain financial wellness.

Both credit unions and banks provide consumers with financial services and products, but there are many distinctions between the two. The primary credit union difference lies at its core: Banks are created to generate profit for owners while credit unions are created to provide members with a place to manage their finances at the best possible terms.

The goal of putting members first is deeply rooted in the history of the credit union movement.

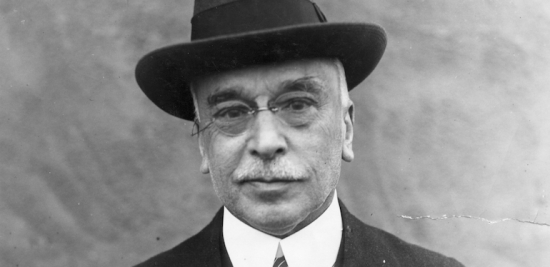

The first credit union was established in 1864 by Friedrich Raiffeisen in southern Germany. Raiffeisen proposed that all community members pool resources so individuals in need of loans could easily access the necessary funds. Raiffeisen’s idea was well-received, and the first credit union model was soon established.

In 1909, the credit union movement reached American shores. With Edward Filene serving as its pioneer, the movement gained momentum and continued to grow. In 1920, Filene hired attorney Roy F. Bergengren to assist him in generating the movement’s expansion. Bergengren created a more systematized concept for the credit union we know today.

In 1934, President Franklin D. Roosevelt signed the Federal Credit Union Act into law. Federally chartered credit unions in every state were legally authorized to create a system of not-for-profit cooperatives to promote thrift and sound financial practices.

In 1970, the public’s confidence in the credit union model grew stronger as the National Credit Union Share Insurance Fund was established. With it, credit union deposits became federally insured much like the FDIC insures bank deposits.

The credit union movement was growing at its most rapid pace, with credit union assets in America tripling between 1970 and 1979. Then, in 1977, another credit union-friendly regulation was signed into law, empowering credit unions to offer more services and products to members.

Today, the credit union movement continues to thrive and is backed by the “full faith and credit of the United States Government.” These not-for-profit institutions serve more than 103 million members by always putting their members’ needs first.

Here at IECU, we’re proud to join the chain of institutions committed to the credit union mission. As a member-owned cooperative, our only objective is your success.

Be a part of credit union history by calling, clicking or stopping by today to benefit from our personalized service!

Don't Get Caught Up in a Tax Return Scam!

It’s tax season, and that means millions of taxpayers are prone to scammers, who are trying to pocket rufunds that aren’t their’s. Here’s what to know about tax return scams and how to avoid them.

How the scams play out

In a tax return scam, a fraudster steals a taxpayer’s personal information and files a fake tax return on their behalf. The scammer directs the refund into the taxpayer’s checking account. After it’s deposited, the scammer calls the victim impersonating the IRS and claiming the refund was mistakenly inflated. They’ll instruct the victim to return the alleged extra funds via gift card or wire transfer. Of course, this money goes directly to the scammer.

In another variation, a scammer steals a taxpayer’s info, files a fake tax return in the scammed person’s name and directs the refund into the scammer’s account.

Protect yourself

Here’s how to keep your money and your information safe during tax season:

- File early.

- E-file using a secure computer.

- Keep tax returns in a secure location.

- Never download links or attachments from unverified sources.

- Never share personal information with an unknown contact over the phone or online.

Knowing the following can also alert you to possible scams:

- Refund checks will never be deposited into a taxpayer’s account if they haven’t filed. If a refund lands in your checking account and you know you haven’t yet filed your taxes, you’re likely the victim of a tax return scam.

- The IRS never demands payment by a specific method. If you’re asked to wire money or pay by gift card, you’re talking to a scammer.

If you’ve been targeted

If you get a phone call or letter from someone claiming to be the IRS and stating that you owe tax money, verify it by calling 1-800-829-1040. Emails allegedly sent by the IRS are scams (because they simply don’t do that).

If you haven’t received your tax refund within one month of filing, check your refund’s status on the IRS webpage. If the site shows that your refund was issued, but you haven’t received it, you may be the victim of a tax return scam and identity theft. Alert the IRS at 1-800-908-4490.

Stay safe!

Beat the Back to School Blues!

Our Back-to-School Loan Special can help you check off your whole back to school list! If having some extra cash would help cover school supplies, new clothes or basically anything you need - even if it's non-school related, then Illinois Educators Credit Union can certainly help!

IECU’s Loan Special is a very convenient lower finance rate option than most higher rate credit cards. Our signature loan special offers you up to $2,500 with a rate as low as 8% APR*, and up to 11 months to pay back the loan.

Start the application process and apply online by clicking the button below or by calling us at 217-528-2642. Hurry before this special ends on September 30, 2021!

*APR=Annual Percentage Rate. Final rate based on credit worthiness. Some restrictions apply. Must fall within IECU lending guidelines. Promotion valid through 09/30/2021.

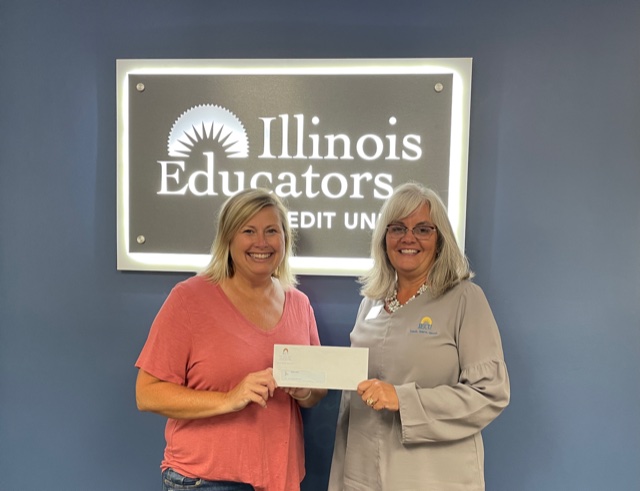

Congratulations to Our 2021 Education Grant Recipients

We had a lot of amazing applications and we were excited to be able to award three grants. Click below to read a summary of the winning applications!

Lisa Campbell- Eat Well, Be Well!

Mindy Daley- Summer Reading Books

Lisa Schweska- We Know What's Happening

Congratulations to Lisa Campbell from Graham Elementary, Mindy Daley from Wilcox Elementary and Lisa Schweska from Sandburg Elementary!

Easy Funding for Higher Education Costs

How to Use a Personal Line of Credit for Higher Education Costs

A personal line of credit, also known as a revolving line of credit, is similar to a credit card which allows you to instantly borrow to meet your cash needs. Once the line of credit is established, your access to funds is seamless. You are able to simply go online to transfer funds to your checking account or visit your financial institution for an advance.

A line of credit is secured by your signature and your promise to repay. Just like a credit card, you only pay interest on the amount you draw against the line of credit. The interest rate associated with this type of loan is usually higher than those secured by real estate and even an automobile, and typically are reflective of your credit score. From the view of the lender, the risk of granting a line of credit is higher when there is no collateral securing a loan. On the flipside, as a borrower, the risk is higher too, since you have nothing to sell to pay back the loan should you unfortunately fall on hard times. Therefore, a personal line of credit should be used with caution and with well thought out intentions.

At IECU we’ve had several members use a line of credit to pay for higher education. They are able to access funds when they need them, as opposed to a student loan where you are advanced a lump sum and pay a fee plus interest based on that entire lump sum from day one. With a line, our member pays the school as needed and, as mentioned earlier, only pays interest on the amount used.

For comparison purposes, here are two IECU members who recently received their MBA: Each semester is $4,500 for a total program cost of $18,000. With books and a living expense allowance, Jane receives a student loan of $7,000 each semester. After the 4% fee a deposit of $6,720 is made into her checking account. At the end of her two-year program, she has student loans of $28,000 at a rate of 4.5% and will begin monthly payments of $215 for the next 15 years. Her classmate John instead uses his line of credit to write a check to the school each semester for $4,500. He begins making $200 monthly payments after his first advance. At the end of his two-year program, he has an outstanding balance of just under $15,000. John will continue the monthly payment of $200 at a rate of 7.5% interest for just 8 years. Using a personal line of credit in this instance saved John 7 years of payments ($200 x 84 = $16,800).

Reaching your educational goals is priority at IECU. While it’s always great to create a budget to take care of most of your financial needs, sometimes that is not always possible. We’d love to chat with you about how a personal line of credit might help you earn your next degree.

Advance Child Tax Credit Payments

Due to the American Rescue Plan Act of 2021, beginning July 15 many families will receive half the total Child Tax Credit as an advance this summer. This means that households will be receiving this credit over the next few weeks either by direct deposit or by mail. These changes apply to the 2021 tax year only.

To qualify for payments, you and your spouse must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return; or

- Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers: Enter Payment Info Here tool; and

- A main home in the United States for more than half the year (the 50 states and the District of Columbia) or file a joint return with a spouse who has a main home in the United States for more than half the year; and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number; and

- Made less than certain income limits.

For more information about the status of your payment, additional resources or to update your account information with the IRS, please visit irs.gov for details and instructions.

Advance Child Tax Credit Payments received via ACH at IECCU will be treated in the same way as previous stimulus payments or any Federal ACH Payment.

Less Paying. More Playing

Skip a Pay is back! Skip up to TWO* loan payments this summer!! With our summer special, the fee is reduced to only $25.

A completed Skip a Pay application is required, along with a $25 fee for each skipped payment. Applications can be completed directly through IECU's Virtual Branch online banking or also available in the IECU Offices. When the Skip-a-Pay period is over, your payments will resume as usual per your loan agreement.

*Some restrictions apply. Skip-a-pay is available on loans with balances of at least $500 and up to $30,000, excluding mortgages and Visa credit cards. Fee is $25 per loan per month, which will be deducted from your account. Only two payments per loan can be skipped in a 12 month period with six full prior payments received. Loan payments may be skipped starting July 1st and ending August 31st at the reduced fee. Fee does not apply towards principal or interest.

3 Signs You Have Outgrown Your Home

Many homeowners are surprised when they suddenly realize that the “perfect” home of just a few years ago no longer suits their needs. And since we were stuck at home for year, it’s hard to not notice!

If you’re unsure if you’ve reached the point where a move is warranted, here are a few signs you’ve outgrown your home:

- More Kids than Rooms or More Rooms than Kids – Life changes and our homes must change also.

- Home Office – Since COVID, more and more companies are opting for telecommuting or home office workers, if your kitchen is your office, it might be time to look for a new home with extra room for a home office.

- Lifestyle – The square footage might be fine, but you would prefer a different floor plan; more open, single story, more windows, etc.

Your reasons for moving will be as unique as you are, but these are just a few considerations which indicate you may have outgrown your current home. If you checked any of these boxes, stop by IECU to talk with our mortgage expert, Gaspare Gallina. We provide solutions for all of your mortgage needs with a complete suite of loan options. Contact us today to get pre-approved!

Apply for an IECU Mortgage Get a Quote Today!

Up to $6,000 available in Downpayment Assistance!

Do you feel that you’re ready to move into a larger home? Tired of paying your landlord’s mortgage? There are many reasons why people decide it could be time to buy a home.

Illinois Educators Credit Union’s top 3 reasons to buy a home include:

1. Financial Advantages – A home is an asset that should appreciate over time, providing wealth-building opportunities.

2. Pride of Ownership – As a homeowner, you control the environment in which you live.

3. Roots –There is a natural desire to be part of a community: to have a local coffee shop, dry cleaners, bar, park.

When buying a new home, coming up with cash for the down payment and closing costs is one of the biggest hurdles. Luckily, there are grants and loans available to help home shoppers become homeowners.

Through the Downpayment Plus® Program*, up to $6,000 may be available to eligible home buyers to use toward down payment and closing costs. Ask one of our loan officers today

about the Downpayment Plus Program to see if you are eligible.

Home buyers must meet income eligibility requirements and:

- Contribute at least $1,000 to the purchase of the home

- Complete pre-purchase home buyer education and counseling

- Live in the home as your primary residence

IECU is committed to helping our neighbors. We can help lower your borrowing costs if you qualify for the Downpayment Plus Program.

Apply for an IECU Mortgage Get a Quote Today!

* Downpayment Plus is a program from the Federal Home Loan Bank of Chicago. Restrictions apply. Please see the Federal Home Loan Bank of Chicago’s website at www.fhlbc.com for complete requirements. “Downpayment Plus” is a registered trademark of the Federal Home Loan Bank of Chicago.

Your Branch on Your Time

Banking on the go is easier than ever with updated mobile options from IECU! You can access your accounts through our updated mobile banking app to stay on top of your finances.

.png)

With our new mobile banking experience, there are some changes that will affect the products and services we provide to you. We want you to be aware of these changes and ask that you to carefully read this blog to help ensure the transition to the new mobile experience, causing you as little disruption as possible.

If you do not currently use the mobile app and only use online banking through our website, this will not interrupt online banking services.

How do you download the app?

If you have our current app, you will need to delete it and download the new one from the app store to your phone. You can find it in Apple App Store and Google Play, by searching "Illinois Educators Credit Union" or clicking the appropriate button below.

How do you log in?

You will use your same login as your online banking credentials, but if you currently use your account number as your online banking login, you will need to change it by clicking the lock in the upper right corner when inside online banking. For security reasons, the app will not allow you to use your account number as your log in.

If you are currently not an online banking user, click here to enroll on our website or give us a call!

Why Are We Changing?

This new platform will feature a wide range of new and upgraded tools and services such as Bill Pay and CardValet right inside the app. These new features are designed to make it easier for you to manage your money—anytime, anywhere. And with every upgrade, we added stronger security. This provides you with more peace of mind knowing that your money and personal information is safe

Be sure to download the new mobile app today before the old one is disabled on April 30, 2021

6 Ways to Spend Your Stimulus Responsibly

Have you received your COVID-19 stimulus payment or are you expecting it soon? Have you started thinking about how you would spend it?

It’s tempting to think about all of the ways you could spend an extra $1,200 or $2,400 – depending your filing status and the number of dependents you claim. Before you get that list finalized, we want to give you some tips to help your money stretch as far as possible.

Prioritize.

Look at your bills. What are essential – rent or mortgage, car payment, utilities – and what bills are non-essential – entertainment, streaming services, unusable memberships? Make a list of what you need and what you can live without. Focus on paying the essential bills first.

Save. Save. Save.

Don’t miss an opportunity to pad your savings account with some of your stimulus money. It’s a one-time payment so think of your stimulus as a mini emergency fund. You may want to set aside some of the payment as “in case” money.

Divide and conquer.

You only get one stimulus payment, but your bills will still come monthly. If you’re currently unemployed, it’s especially important to be strategic in how you spend your stimulus payment. Take this opportunity to divide it up into smaller chunks to help cover some of the essential bills you pay each month. Also, talk to your landlord or mortgage lender, your utility company and internet service provider if you’re having trouble meeting your monthly obligations. A lot of companies are finding ways to help their customers during this unprecedented situation.

Don’t hoard cash.

Hoarding cash is a bad idea in general. Your money is much safer at your credit union than it is in your home. The National Credit Union Administration insures amounts up to $250,000. So, bring it to us and let us keep an eye on it. Plus, if you have a checking account that has a cashback option, you could make money on it while it sits in your account.

Pay down debt.

Paying off debt is almost never a bad financial move but think about it and prioritize carefully. Even in these uncertain times, paying off your highest-interest debt isn’t a bad idea. But, don’t feel like you need to be in a hurry to spend all your stimulus money on paying off debt. Look at your options for forbearance, payment deferrals or even the option to skip a monthly payment. If you can get some relief on your debts in the coming months, let that stimulus payment sit in your savings account.

Splurge Smartly.

We’re all feeling the weight of stress, grief and uncertainty as we wonder when this pandemic will end, and life will return to normal. No matter how you decide to spend your stimulus check, set aside a little bit to spend on something fun for yourself. Maybe even shop at some of your local businesses to offer support. Remember: the government is hoping these stimulus payments will put some cashflow back into the economy to stimulate it.

Over the past couple of months, we’ve faced a situation no one could’ve possibly prepared for. We know that our members have been affected in some way by the COVID-19 pandemic. While the stimulus payments will certainly help and offer some relief to most, please know that Illinois Educators Credit Union is here for you. We want to help you stretch your stimulus payment as far as it will possibly go. Maybe you need to skip a monthly payment or you’re looking for a relief loan. Regardless of your needs, give us a call and let us figure out how to help.

Stimulus Payments Are On The Way

Economic Impact payments are on their way, and most Americans have already received their money. But, what does it mean for you if you haven’t?

Where is my stimulus check?

The IRS began sending out stimulus payments in April. But if you haven’t received yours yet, there’s no reason to panic. Retirees, senior citizens, and taxpayers who filed income taxes in 2018 and 2019 and included direct deposit information were the first groups to receive their payments.

If you’re not in one of those categories, you’ll still receive a payment, but it’ll arrive by mail instead of being directly deposited into your checking or savings account. Taxpayers who didn’t include direct deposit information will receive a paper check sometime in May.

The IRS does a feature on its website that will allow taxpayers to provide direct deposit information if their check hasn’t yet been mailed. However, the feature isn’t slated to be up and running until mid-April.

What you need to know about payments

Most taxpayers are eligible to receive a stimulus payment. The payments are automatic, and no further action is needed to receive the payment.

The amount, however, will vary based on filing status, the number of dependents and adjusted gross income (AGI). Individuals or head of household filers will receive $1,200, while married taxpayers filing jointly (if they aren’t a dependent of another taxpayer) will receive $2,400. Taxpayers will receive up to $500 per dependent claimed on their federal tax returns in 2018 and 2019.

Stimulus payments are based on the AGI claimed by the filer. Taxpayers will receive the amounts listed above if they have a work-eligible Social Security number and adjusted gross income up to:

- $75,000 for individuals

- $112,500 for head of household filers

- $150,000 for married couples filing joint tax returns

Taxpayers will receive a reduced payment if their AGI is:

- $75,000 and $99,000 if their filing status was single or married filing separately

- $112,500 and $136,500 for head of household

- $150 and $198,000 if their filing status was married filing jointly

Can I track my payment?

Right now, no. However, the IRS has developed a website that will allow filers to check the payment status, confirm payment type and enter direct deposit information if the check hasn’t been mailed yet. The IRS website indicates that the “Get My Payment” option will be available mid-April.

The website is open to non-filers. If you didn’t file a 2018 or 2019 federal income tax or you weren’t required to, you can enter your information on the IRS website and select the preferred method of payment.

We’re facing an unprecedented situation that seems to be changing daily. Please know, Illinois Educators Credit Union is here for you during this time. If you’re facing an uncertain financial situation, talk to us. Let us help you find a solution that works for you while you’re waiting for your stimulus payment. We have several options available to our members because we want to help them come through this stronger. Please don’t hesitate to reach out and let us know how we can be there for you.

Cash Out?

Along with the mad dash to buy all the toilet paper stores can stock, some members have asked about the need to withdraw cash from the credit union.

The fact is, the need for cash withdrawals during this crisis has no basis in fact. Unlike overextended banks that caused the Great Recession, the current financial crisis was caused by the reaction to the Coronavirus outbreak, not a systemic banking problem.

One Easy Way to Save for Your Dream Car

.png)

The IECU Save to Win CD incorporates all the thrills of the lottery with none of the risk! Here's some helpful tips on how it can help you save for your dream car!

Guide to Good Credit

IECU CEO, Jody, explains how credit can impact lives while offering advice on how to improve and maintain a good credit score.

Money: What's Your Outlook on Saving?

(1).png)

IECU Branch Manager, Mark, explains money and finances and the importance of the two in his everyday life!

Summer Fun Fading Away? Here's My 15 Things To Do This Summer!

Summer days seem to be flying by? Have you run out of things to do? Here's my list of 15 things to do in the summer time!